Internal documents reported by Reuters reveal that Meta projected it would earn about 10% of its 2024 revenue — roughly $16 billion — from ads promoting scams, illegal goods, fraudulent investment schemes, and banned products.

The same cache of documents shows Meta’s platforms served an estimated 15 billion “higher-risk” scam ads every single day in late 2024 — ads that internal systems flagged as likely fraudulent but still allowed to run. This was not a rounding error; it was large-scale monetization of fraud built directly into the ad business.

The leaked material lists a wide range of scams: fraudulent e-commerce stores, fake investment and crypto schemes, rip-off casinos, counterfeit medical products, and aggressive “get rich quick” pitches — the same categories regulators have warned about for years.

Internal risk dashboards reportedly flagged this as a major “revenue-integrity threat,” yet enforcement stayed weak. Instead of cutting off suspicious advertisers, the company often just charged them more.

According to the documents, Meta relied on higher “penalty bids” and only banned advertisers once internal models were more than 95% certain they were fraudulent. Anything below that threshold kept spending — and kept running, allowing many scam networks to escape bans entirely.

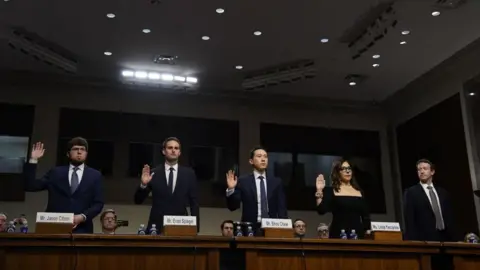

The revelations have already triggered political blowback. U.S. Senators have urged the Federal Trade Commission and Securities and Exchange Commission to investigate whether Meta knowingly profited from illegal activity. Consumer advocates pointed out that each “high-risk” ad corresponds to real victims losing savings to scams that were facilitated through Meta’s systems.

Meta spokesman Andy Stone acknowledged the internal estimates but argued that the “10%” figure was “rough and overly-inclusive.” He noted the company's efforts to combat fraud, claiming a 58% reduction in user reports of scam ads. However, the leaked documents hint that potential revenue loss was often prioritized over enforcement against fraudulent ads.

This scandal raises crucial inquiries about the ethical implications of a tech giant allowing ad revenue from scams and stresses the need for regulators to demand accountability and consider reversing profits obtained through deception.