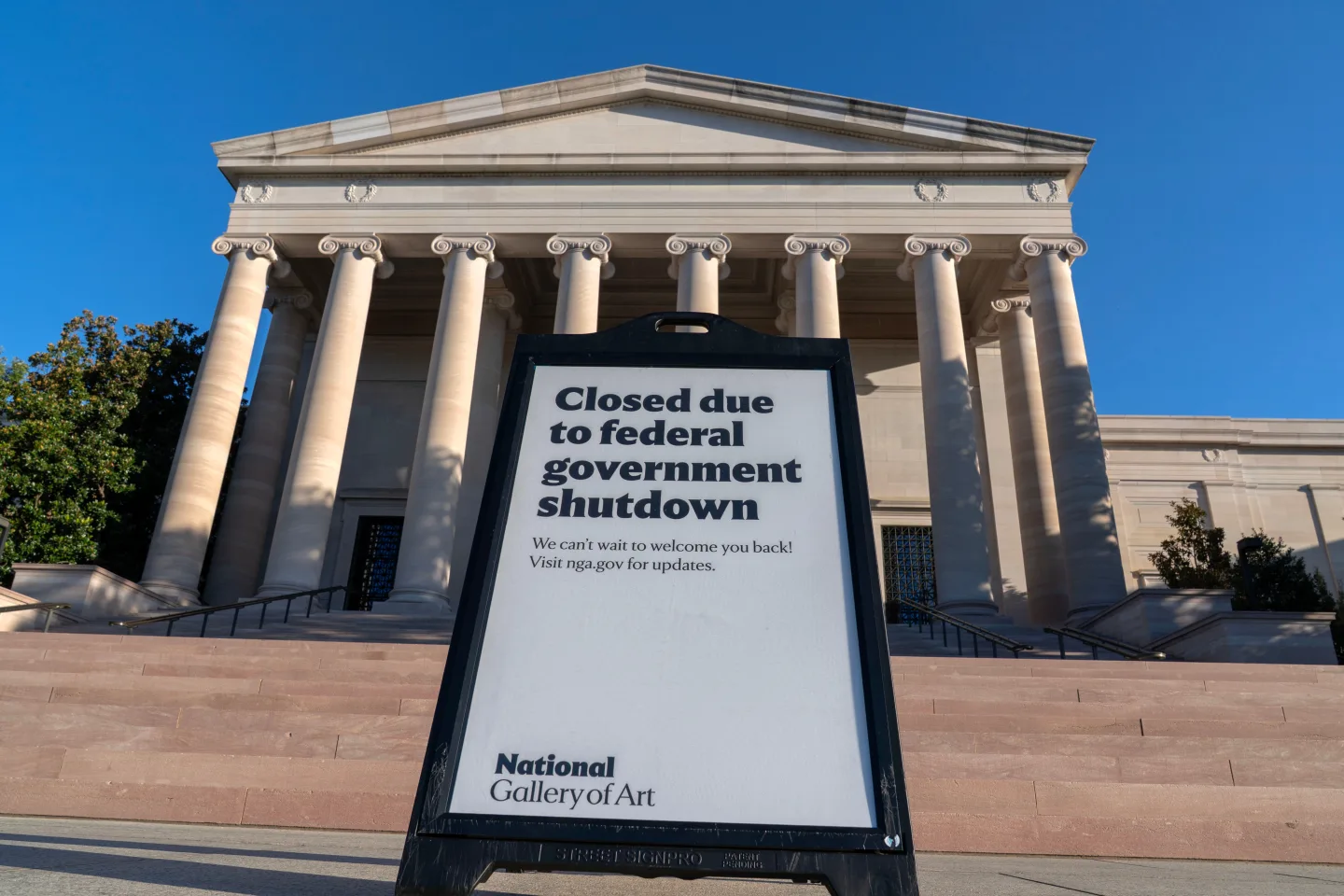

President Trump has officially signed his major tax and spending legislation into law, a pivotal move following its narrow passage through Congress. This significant event coincided with 4th of July celebrations and aims to advance his agenda, which includes substantial tax cuts, increased defense budgets, and strict immigration policies.

While rallying supporters in Iowa, Trump heralded the bill as a catalyst for economic growth, despite public skepticism reflected in polls indicating widespread disapproval. Notably, some Republicans opposed the bill, raising alarms about its contribution to the rising national debt, while Democrats criticized it for favoring the wealthy at the expense of lower-income Americans.

The 870-page bill extends Trump's 2017 tax cuts, implements cuts to Medicaid—which provides health care for low-income citizens—and introduces tax breaks affecting overtime pay and Social Security. Additionally, it allocates $150 billion toward defense and proposes a significant reduction in clean energy tax credits as well as funding for immigration enforcement.

The passage came only after extensive negotiations within Congress; the final vote in the House saw only two Republican defections, while every Democrat opposed it. The tight vote of 218 to 214 followed a lengthy speech by House Minority Leader Hakeem Jeffries, who condemned the legislation as detrimental to American healthcare.

Despite sharing his triumph in Iowa by celebrating America's upcoming 250th birthday, experts suspect these tax cuts are unlikely to curb rising deficits. Analysis indicates that wealthier individuals will reap most of the tax benefits, while many low-income Americans face stark cuts to essential programs like the Supplemental Nutrition Assistance Program (SNAP), which helps millions afford food.

As many brace for the impacts of these changes, a significant portion of the public remains unaware of the details surrounding this landmark bill.