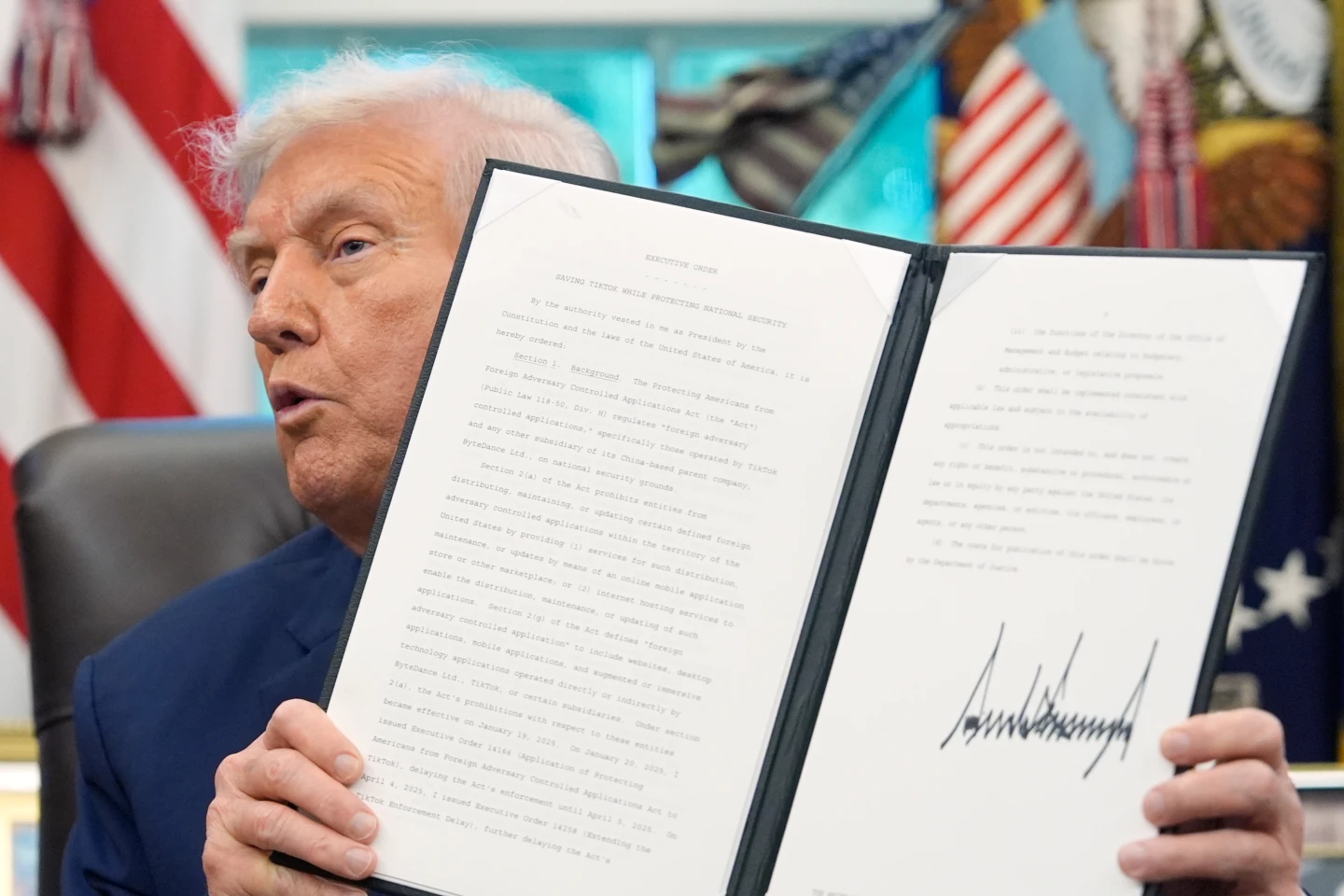

To facilitate Nippon Steel's acquisition of U.S. Steel, the Trump administration has struck an unusual agreement that bestows a “golden share” to the U.S. government. This arrangement grants President Trump and future presidents remarkable influence over the private company’s operations. The deal aims to change how foreign investments are handled in the U.S., raising intriguing questions about government oversight of private industries.

The negotiations, which stretched late into the night, resulted in Nippon Steel agreeing to grant a permanent stake to the U.S. government, contravening their initial proposal for a limited time of three to four years. The talks, guided by Commerce Secretary Howard Lutnick, emphasized the need for continued government control over U.S. Steel's board and decision-making processes.

Under the terms of the agreement, the U.S. government will hold a preferred class of shares, significantly impacting the company’s operations by requiring presidential approval for nearly a dozen of its major activities. The move could redefine the landscape of foreign investment in America, raising diverse opinions about the balance of corporate autonomy and governmental oversight.