In the wake of recent stock market swings, many Europeans, like retired business owner Susie James from Wales, remain largely unfazed. Ms. James, having experienced two major financial crashes in her lifetime, attributes her indifference to a long-standing distrust of the stock market, preferring to keep her savings in cash.

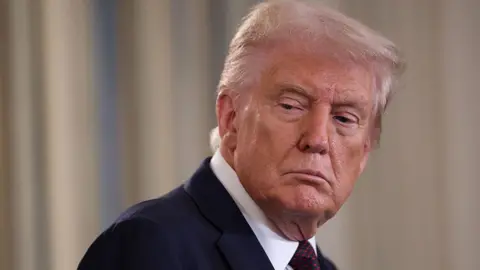

Statistically, Europeans save more than Americans, with about a third of their financial assets held in cash or low-risk deposits, according to the European Central Bank. In contrast, Americans typically have only 10% in these safer options. This conservative financial approach has cushioned many Europeans from the wild fluctuations driven by President Trump's tariffs and their impact on the global economy.

However, the cost of this strategy is significant. While around 33% of households in the European Union invest in stocks and funds, this pales in comparison to the 51% seen in the United States, reveals Bruegel, an economic research institute. Moreover, investment trends vary across Europe, with Scandinavian countries leading and nations like Spain, France, and Italy lagging behind significantly.

As a result, while European savings may provide some peace of mind, they are also leaving substantial earnings on the table, with the continent missing out on trillions in investment growth opportunities.