The gold price has hit another record high, trading above $4,400 (£3,275) an ounce for the first time.

The price of the precious metal has risen on expectations the US central bank will cut interest rates further next year, analysts said.

Gold started the year worth $2,600 an ounce, but geopolitical tensions, the Trump tariffs and expectations of rate cuts have added to investor demand for safe haven assets, such as gold and other commodities.

The prices of other precious metals also rose on Monday, with silver hitting a record high as well.

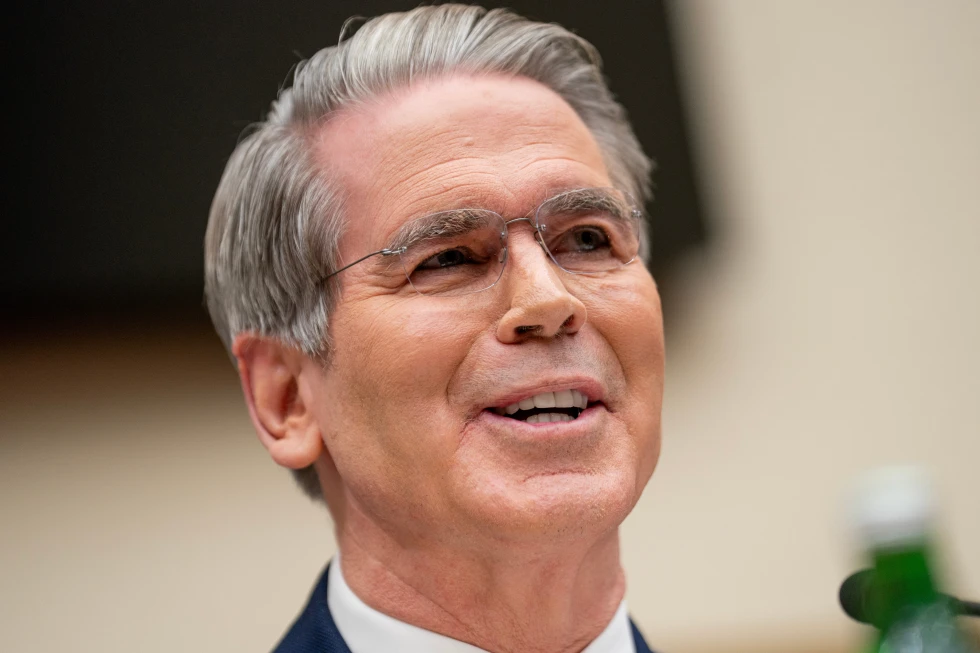

The gold price has risen more than 68% this year, the highest increase since 1979, according to Adrian Ash, director of research at gold bullion marketplace BullionVault.

2025 has seen slow-burning trends around interest rates, around war and trade tensions, Mr Ash said, which have helped to push up the price of gold.

After passing the $4,400 an ounce mark on Monday, the spot price of gold hit a high of $4,426.66.

Lower interest rate expectations typically mean lower returns for investments such as bonds, so investors look to commodities such as gold and silver to get a return, but also diversify their portfolios.

The consensus among analysts currently is that the US will lower interest rates twice in 2026.

Another factor adding to demand is that central banks globally are expanding their own physical holdings of gold as a way to counter economic turbulence, reduce reliance on the US dollar, and diversify their own portfolios, according to analysis from Goldman Sachs, which predicted the pattern would continue in 2026.

A weaker US dollar has also helped push gold prices higher by making the metal cheaper for overseas buyers.

Silver also reached a record price of $69.44 an ounce, up 138% this year. Both gold and silver are seen as ways for traders to mitigate the risks tied to economic instability.

This upward trend highlights how investors view these precious metals as security in times of uncertainty.