The health insurance enrollment window opens soon, but shoppers are facing a challenging landscape with potential price hikes and government shutdown impacts. Starting this Saturday, millions can select coverage options, all while the upcoming premiums are expected to increase substantially due to political tensions in Congress over tax credits.

According to KFF, the average premium hike is projected at 20%, pushing many insurance customers to reconsider their plans this year. Shoppers must make selections by December 15th for coverage starting in January, leaving little time to navigate the shifting market dynamics.

It's crucial to explore your options now, despite the confusion. Don't let the increased prices deter you from finding what you need, advises insurance expert Sara Collins.

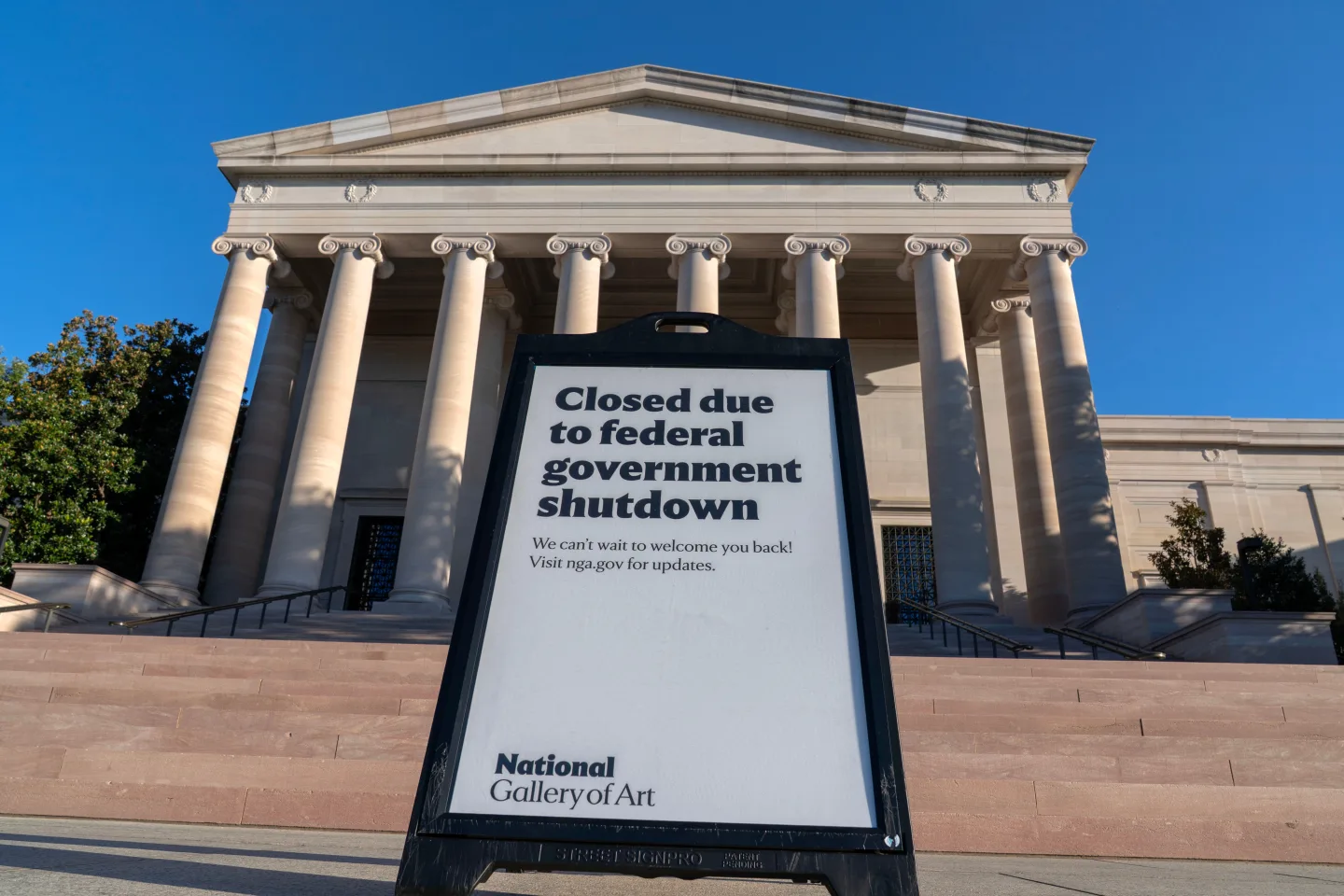

Political hurdles are added complications in this process, as the government shutdown has stalled discussions on extending important tax credits that help many afford coverage. With many less navigators available, first-time buyers might especially struggle to find guidance.

For those seeking coverage, the key is to start at their state marketplace, ensuring they fill out applications for tax credits promptly. Early action is critical as shoppers may not have continued assistance throughout the enrollment window due to funding cuts from the Centers for Medicare and Medicaid Services.

In these uncertain times, health care pricing is increasingly complex. But with the right tools and timing, consumers can still find the coverage they need.