Evergrande Group, once heralded as China's largest property developer, is facing delisting from the Hong Kong stock exchange, symbolizing its dramatic decline. With a staggering debt of around $300 billion, the company has been at the center of a real estate crisis plaguing China's economy for years. The firm began to unravel after government regulations limited borrowing in 2020, forcing it to offer steep discounts on properties to raise funds, ultimately leading to defaults on its overseas debts.

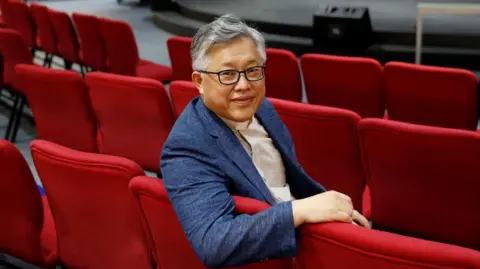

Founded by Hui Ka Yan, who once topped Asia's wealth rankings, Evergrande's worth has plummeted from about $50 billion to a meager fraction due to its financial mismanagement and a recent court order mandating its liquidation. The fallout has deeply affected China's economy, which relies heavily on the real estate sector, contributing to suppressed consumer spending amidst rising unemployment rates.

Experts foresee a protracted recovery for the property market, even as the Chinese government attempts to stimulate the economy through various initiatives. While some believe that the market has hit rock bottom, skepticism remains regarding a robust recovery. With additional developers on shaky ground, the reverberations of Evergrande's collapse serve as a cautionary tale for the future of China's real estate landscape.

Founded by Hui Ka Yan, who once topped Asia's wealth rankings, Evergrande's worth has plummeted from about $50 billion to a meager fraction due to its financial mismanagement and a recent court order mandating its liquidation. The fallout has deeply affected China's economy, which relies heavily on the real estate sector, contributing to suppressed consumer spending amidst rising unemployment rates.

Experts foresee a protracted recovery for the property market, even as the Chinese government attempts to stimulate the economy through various initiatives. While some believe that the market has hit rock bottom, skepticism remains regarding a robust recovery. With additional developers on shaky ground, the reverberations of Evergrande's collapse serve as a cautionary tale for the future of China's real estate landscape.