The European Parliament is planning to suspend approval of the US tariffs deal agreed in July, according to sources close to its international trade committee.

The suspension is set to be announced in Strasbourg, France on Wednesday.

This move would mark another escalation in tensions between the US and Europe, as Donald Trump ratchets up his efforts to acquire Greenland, threatening new tariffs over the issue on the weekend.

The stand-off has rattled financial markets, reviving talk of a trade war and the possibility of retaliation against the US for its trade measures.

Shares on both sides of the Atlantic were lower on Tuesday, with European stock markets seeing a second day of losses and the three main US stock indices down by more than 1% in morning trading.

On the currency markets, the US dollar also fell sharply. The euro climbed 0.8% against the dollar to $1.1742 while the pound rose by 0.2% to $1.346.

Borrowing costs also rippled higher around the world, as the biggest sell-off of long-term government debt in months drove up yields on 30-year bonds in markets including the US, UK, and Germany.

Trade tensions between the US and Europe had eased since the two sides struck a deal at Trump's Turnberry golf course in Scotland in July that set US levies on European goods at 15%, down from the previously threatened 30%.

However, after Trump's recent aggressive comments, influential German member of the European Parliament, Manfred Weber, stated that approval is not possible at this stage.

The EU's previous plan to retaliate against US tariffs targeting €93bn worth of American goods is also at stake, as it needs to finalize the details before the new levies come into play.

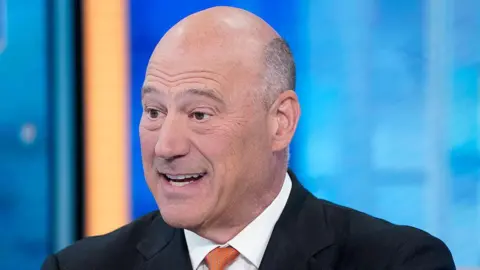

Amid these rising tensions, US Treasury Secretary Scott Bessent advised European leaders against retaliation, urging them to be open-minded.

The ongoing trade dynamics highlight the deep economic interdependence between the US and EU, who are each others' largest trade partners.