China's economy has exceeded expectations, achieving a 5.2% growth in the second quarter, despite the potential impact of U.S. President Donald Trump's tariffs and persistent issues within the property sector. This growth surpasses the 5.1% many economists anticipated, although it is slightly lower than the previous quarter's performance.

The official reports highlight that China has managed to sustain economic stability, buoyed by government measures aimed at economic support and an ongoing delicate trade agreement with the U.S. The National Bureau of Statistics attributed the growth partly to a 6.4% rise in manufacturing driven by demand for technology and industrial goods. Sectors such as transport, finance, and tech contributed positively as well.

However, there are signs of slowing retail sales, which grew by only 4.8% in June, a drop from 6.4% in May. Additionally, new home prices experienced their most significant monthly decline in eight months, indicating ongoing struggles in the real estate market.

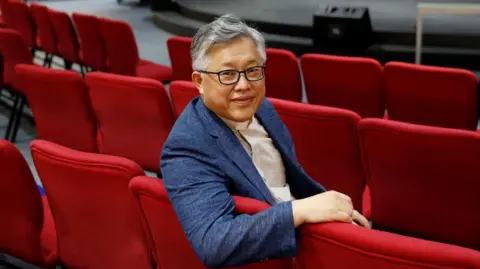

Despite expectations that tariffs would have a more adverse effect, economist Gu Qingyang assessed China's economy as "highly resilient." Exports saw an uptick as businesses worked to avoid tariffs by shipping products ahead of the deadline. While the latter half of the year brings some uncertainty, it appears that achieving the annual growth target of around 5% is still plausible.

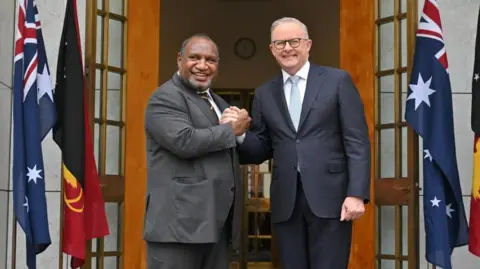

Some analysts, however, express doubts about maintaining this target. Dan Wang, from consultancy Eurasia Group, suggested the growth may not exceed 4%, interpreted as a politically acceptable threshold. The trade battle has driven the U.S. to impose heavy tariffs on Chinese imports, leading to reciprocal measures from Beijing. Recent negotiations provided a temporary pause, as both nations strive to finalize a long-term agreement before the August deadline.

The official reports highlight that China has managed to sustain economic stability, buoyed by government measures aimed at economic support and an ongoing delicate trade agreement with the U.S. The National Bureau of Statistics attributed the growth partly to a 6.4% rise in manufacturing driven by demand for technology and industrial goods. Sectors such as transport, finance, and tech contributed positively as well.

However, there are signs of slowing retail sales, which grew by only 4.8% in June, a drop from 6.4% in May. Additionally, new home prices experienced their most significant monthly decline in eight months, indicating ongoing struggles in the real estate market.

Despite expectations that tariffs would have a more adverse effect, economist Gu Qingyang assessed China's economy as "highly resilient." Exports saw an uptick as businesses worked to avoid tariffs by shipping products ahead of the deadline. While the latter half of the year brings some uncertainty, it appears that achieving the annual growth target of around 5% is still plausible.

Some analysts, however, express doubts about maintaining this target. Dan Wang, from consultancy Eurasia Group, suggested the growth may not exceed 4%, interpreted as a politically acceptable threshold. The trade battle has driven the U.S. to impose heavy tariffs on Chinese imports, leading to reciprocal measures from Beijing. Recent negotiations provided a temporary pause, as both nations strive to finalize a long-term agreement before the August deadline.