Electronic Arts (EA), one of the biggest gaming companies in the world, has agreed a deal to sell the company for $55bn (£41bn).

The consortium of buyers include Saudi Arabia's Public Investment Fund (PIF), Silver Lake and Jared Kushner's Affinity Partners.

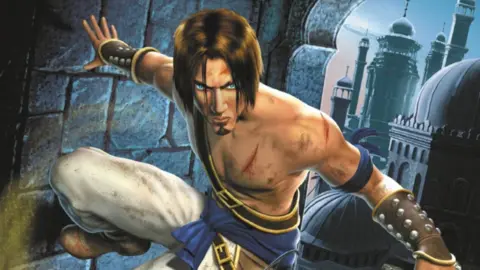

EA is known for making and publishing best-selling games such as EA FC, formerly known as FIFA, The Sims and Mass Effect.

It is understood to be the largest leveraged buyout in history - where a significant amount of the purchase is financed by borrowing money.

The deal will take EA private - meaning all of its public shares will be purchased and it will no longer be traded on a stock exchange.

The purchase price puts a significant 25% premium on the market value of EA, valuing it at $210 per share.

It is the second most valuable gaming purchase in history, following Microsoft's $69bn deal to buy Call of Duty publisher Activision Blizzard.

In the end, the deal was only approved after Microsoft handed the rights to distribute the firm's games on consoles and PCs over the cloud to Assassin's Creed-maker Ubisoft.

EA boss Andrew Wilson will remain in post, mentioning the acquisition as a powerful recognition of the firm's role in gaming.

The firms buying EA will contribute approximately $36bn, with the remaining amount being financed by loans.

Industry expert Christopher Dring noted that this acquisition signals potential challenges such as $20bn of debt that needs to be managed, raising concerns about future game development.

Saudi Arabia's investment strategy has expanded greatly with this move, enhancing its presence in the gaming industry, having already made significant investments in various gaming projects.

As EA is known for titles that have shaped gaming culture over decades, this acquisition marks a new chapter for the company and the gaming landscape.