In the remote mining area of Eneabba, Western Australia, lies a treasure trove of rare earths locked within a massive pit. This hidden stash holds a million tonnes of critical minerals crucial for electric vehicles, wind turbines, and defense equipment. Australia is pouring A$1.65 billion (US$1 billion) into a mining company, Iluka Resources, for a refinery to tap into this stockpile and diminish China's monopoly over these essential materials.

China currently controls over half of the world's rare earth mining and nearly 90% of processing. Its ability to manipulate supply chains was starkly felt during trade tensions with the US, further emphasizing the need for alternative sources. “The West dropped the ball,” says Jacques Eksteen, chair for extractive metallurgy at Curtin University, highlighting the long-term investment China has made in this sector.

Rare earths, despite their misleading name, are critical for modern technologies. They are used in various components of electric vehicles, from side mirrors to braking sensors. However, most rare earth minerals now depend on China's supply chain, which has raised alarms about reliability and sustainability.

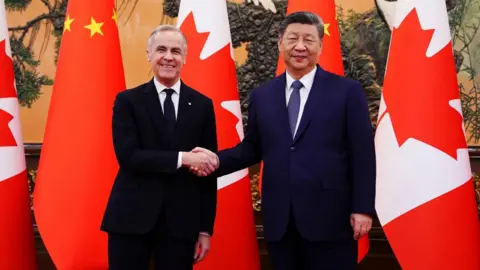

Iluka is transitioning from mining zircon to extracting more profitable rare earths like dysprosium and terbium, diversifying their operations. Building the new refinery may take two years, but there is high demand from industries eager to avoid dependency on China. "A secure and sustainable supply chain outside of China is fundamental for our customers' business," says Iluka’s head of rare earths, Dan McGrath.

As Australia ramps up its rare earth ambitions, it acknowledges the environmental responsibilities that come with it. While China's lax environmental regulations have led to significant pollution issues, Australia has its standards to uphold, striving for responsible practices amid the push for a cleaner supply chain.

While establishing a new industry won’t happen overnight, Australia’s strategic commitment and government backing may offer a brighter, more independent future in the global rare earths market. The clock is ticking for a cleaner solution as it races against time and resource policies that have long favored China.